How to Pay off your Home Faster

Velocity Banking

Pay Off Your Mortgage Faster Using Smart Cash Flow (Not “Magic”)

If you’re tired of feeling like your mortgage balance barely moves, Velocity Banking can help you accelerate payoff by redirecting your existing cash flow to hit principal sooner.

This strategy is most commonly done with a HELOC (Home Equity Line of Credit) or another qualified credit line.

Bottom line: You’re not making extra payments out of thin airyou’re making your money work smarter.

The Key Benefit

Velocity Banking can help you:

-

Reduce interest over time (because mortgage interest is driven by your balance)

-

Pay down principal faster (by making larger principal reductions earlier)

-

Use your regular income more efficiently (same money, better timing)

-

Potentially shorten the life of your loan (depending on your numbers + discipline)

Think of it like walking on a moving sidewalk at the airport. You’re still walking… just getting there faster.

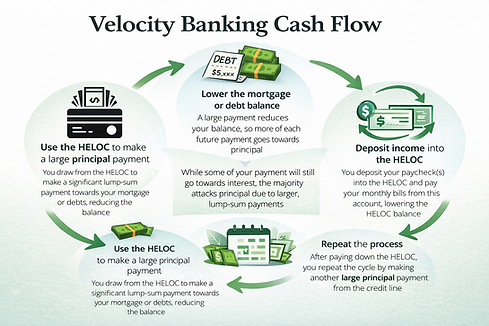

How Velocity Banking Works (Step-by-Step)

-

You open a line of credit (often a HELOC) with flexible access.

-

You use the credit line to make a lump-sum principal payment toward your mortgage.

-

Your mortgage balance drops → less interest accrues going forward.

-

You then route your income into the credit line (paychecks go there).

-

You pay monthly expenses from the credit line as needed.

-

Your income “sits” against the balance, helping reduce interest and paying the line down faster.

-

Once the line is paid down, you may repeat the process.

This approach works best when it’s structured correctly and you stay disciplined.